Artificial Intelligence refers to the ability of a computer to think like a human. It is impacting many industries, bringing with it potential benefits that are predicted to double the annual economic growth rate in the future. However artificial intelligence also brings about new challenges and future implications which are transforming our society.

What is artificial intelligence?

AI is software that can analyse, make decisions and learn new skills. AI spans applications in almost every industry and is predicted to increase corporate profitability in 16 industries across 12 economies by an average of 38% by 2035 (Accenture, How AI boosts industry profits and innovation, June 21, 2017). AI improves productivity by substituting human tasks to be performed by a machine at no cost; for example chatbots and driverless cars.

How artificial intelligence can substitute for humans.

- Processing larger amounts of data at a higher speed and capacity than humans,

- Recognising objects and situations

- Inferring the future state of an object or situation

- Identifying an optimal decision based on past, present and future states.

Within the insurance industry for example, AI has been used to boost data analytics, automate repetitive processes that are data heavy, improve risk analysis and better customer service. Essentially, it gives insurers and their policy holders a much better understanding of their risks, while providing opportunities for new insurance solutions to be developed.

How does artificial intelligence impact society?

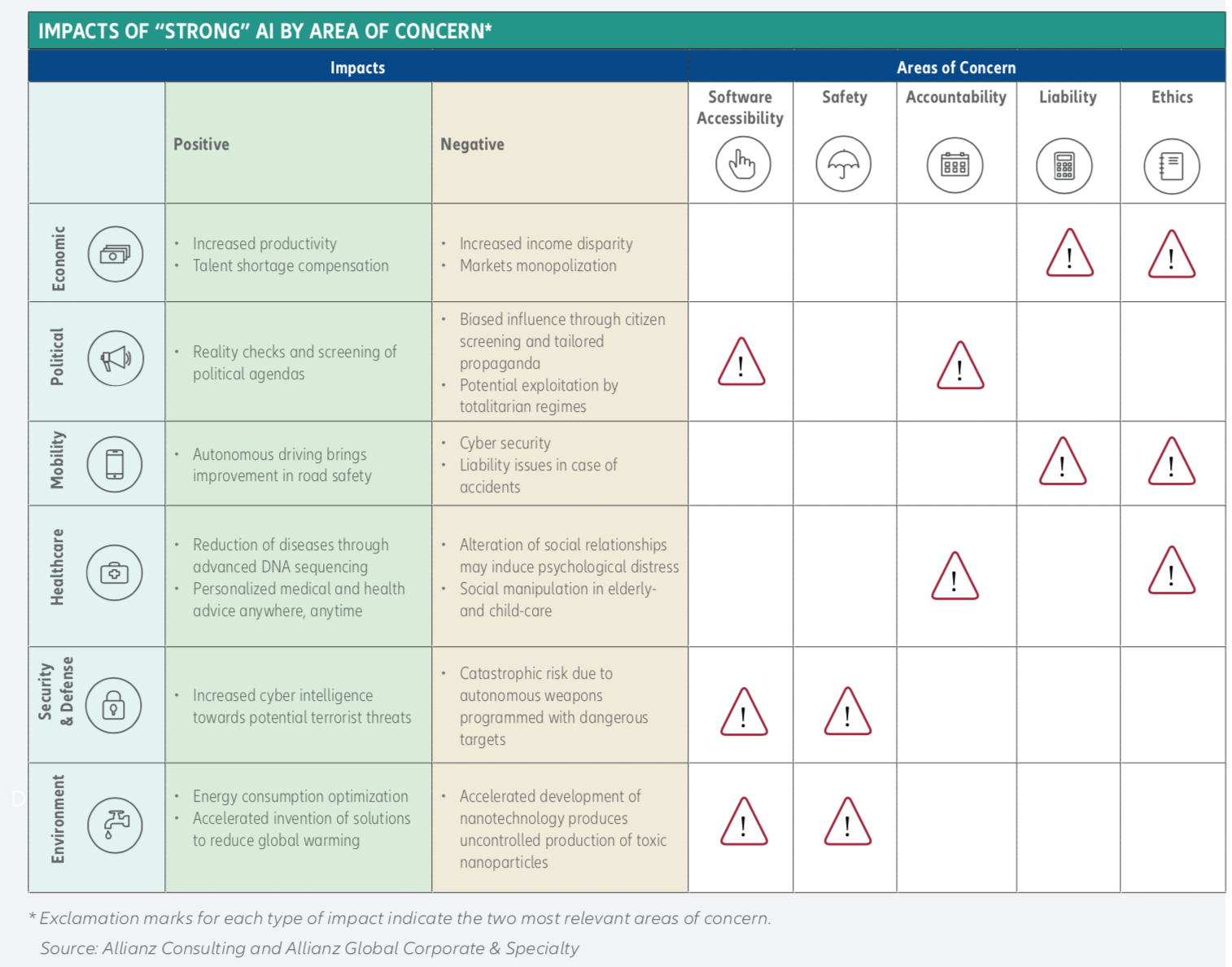

Given the broad scope of application of AI applications across a range of industries, it comes with potential short- and long-term benefits and risks.

- Economic impacts: white AI brings increased GDP by performing existing jobs more efficiently, the substitution of many low-middle income jobs can bring extensive unemployment. Where this occurs, new ways of determining liabilities and mitigating risks are forced.

- Mobility impacts: It is argued that driverless cars are predicted to eliminate human error, thus making our roads safer. AI will also allow transport management systems to better manage our roads. However AI brings about concerns as to who is liable in the case of an accident.

- Healthcare impacts: AI is probably expected to deliver the most societal benefit in healthcare, by eradicating certain diseases, diagnosing and providing specialist advice. Quality of life and life expectancy is expected to increase! However AI within the healthcare sector may be subject to psychological manipulation, and gives rise to concerns about patient privacy in the use of medical records.

- Security and defense impacts: AI software has massive potential to boost global security by helping detect cyber attacks and identify terrorist activities. Conversely, misuse of AI could actually increase the risk of cyber-attacks.

- Environmental impacts: AI technologies are already being used to reduce emissions, fighting climate change. AI robots can also be deployed into harsh environments, being exposed to harmful materials in place of humans. However, AI is a key component for the development of robots, which could have dangerous environmental implications in their production.

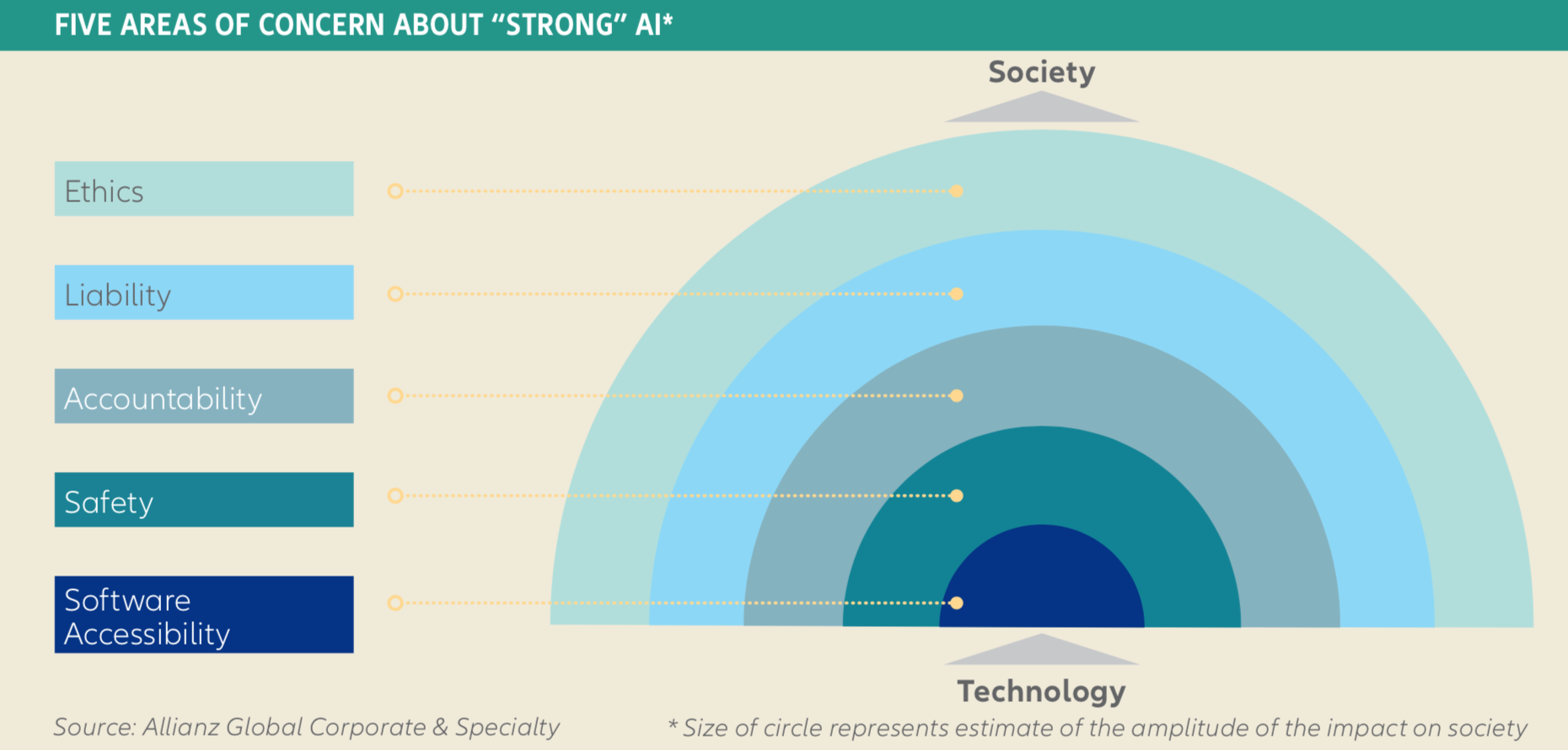

Emerging artificial intelligence risks:

When identifying emerging artificial intelligence risks, there are a number of areas of concern. They are:

- Software Accessibility: AI applications can potentially be developed by anyone who has access to open software code repositories, which allow users to review code, manage projects and build software. This increases the risk of technology misuse, for example cyber security, defense and medical applications.

- Safety: AI systems should be tested in an environment similar to the real world to reduce the risk of unintended accidents. The race for developing AI technologies incentivizes developers to skip steps in this process, meaning that certain applications will increase the vulnerability of a business to cyber-attacks and technical failure.

- Accountability: Accountability refers to the agents ability to make transparent decisions. With more AI agents now making decisions in business, regulators are faced with the difficult task of ensuring that data input and the AI’s process leading to a certain decision being made can be audited (according to consumer protection regulation). Since the algorithms used to build AI applications are human-generated, training data can contain prejudice and biases, resulting in unfair decision making.

- Liability: While AI agents can take over many decision making and physical tasks, they cannot legally be liable for those decisions. Generally, as the manufacturer of a product is liable for defects that causes damage to its users, the same applies to producers of AI agents. However, AI decisions that are not related to design, but are made according to its interpretation of reality leaves no explicit liable parties! This can create expensive legal battles and gross inefficiencies to any business.

- Ethics: Decisions made by AI agents are faster and more accurate in many cases. However in some situations the optimal decision is subjective, dependant on ethical principles necessary to draw conclusions. For example, AI agents are unable to comprehend concepts such as loyalty, happiness or hurt. Neither developers or the law can establish such objective rules, and therefore an AI agent may act against human interests.

The impact of these emerging risks:

- Business risks: the impact of AI and other forms of new technology already rank as the seventh top business risk, ahead of political risk and climate change (Allianz Risk Barometer 2018. Based on 1,911 risk expert respondents). Companies face new liability challenges as responsibility shifts from human to machine. Meanwhile, increasing interconnectivity means vulnerability of automated/autonomous machines to failure or malicious cyber acts will only increase, as will the potential for larger-scale disruptions and losses, particularly if critical infrastructure is involved.

- Labor disruption: AI will no doubt result in many jobs no longer existing anymore. In order to protect citizens from loss of income, governments are experimenting with different forms of subsidies such as increased tax income from AI-driven businesses. We are also likely to see current income protection insurance policies evolve to protect against unemployment circumstances.

- Regulatory non-compliance: Fast-paced technological advances will challenge governments to protect consumers from the negative consequences of inappropriate uses of technology. Consumer protection regulation will force new regulations to emerge, for example implementing human supervision to control and explain AI agents decisions might be the best risk management solution. Data protection regulation will need to be redefined, and so businesses will need to reduce, hedge, or financially cover themselves from risks of non-compliance with new data protection regulations.

- Liability changes: Assignment and cover of liability will become more challenging due to the shift of responsibility from human to machine, and therefore, from manufacturer to supplier. Recalls could become larger and more complex if a series of accidents occur, for example in driverless cars (probably the most well known up and coming AI technology). With driverless cars we may see insurers needing to get compensation from car manufacturers and AI software suppliers because human error will no longer be a factor. Compulsory motor insurance may need to be extended to include product liability cover, giving motorists cover when they hand over full control to their vehicle.

As you can gather, artificial intelligence is a complex emerging technology that will transform our society. There will be many benefits to our everyday lives and to our businesses, however there are a number of emerging concerns which will impact the way we protect ourselves and our assets.

At Omnisure, our brokers remain on the forefront of understanding and creatively sourcing bespoke insurance policies that will protect Australian businesses as artificial intelligence begins to infiltrate the way your business operates. This is of particular importance given the fast-paced nature of these technologies, whereby business owners need to understand how introducing AI agents into their industry changes their risks. If you would like to chat to one of our expert brokers about the technologies used within your business and to keep your risks in check, we would love to hear from you. Give us a call on (02) 9959 2900 or jump over to our team page to contact any of our brokers directly.

This article is based off of information derived from the Allianz Global Corporate & Specialty: The rise of Artificial Intelligence: future outlook and emerging risks report. You can download a the full report here: Artificial_Intelligence_Outlook_and_Risks full report.