Chapter 13. Insurance Considerations –

Agricultural & Impact Fund Managers Part II

Introductory articles on emerging exposures, risk mitigation

and insurance risk transfer for clients of Omnisure.

A compendium of introductory ESG articles on emerging exposures, risk mitigation and

insurance risk transfer for clients of Omnisure with claims examples.

Martin Birch – March 2022

![]()

Chapter 13. Insurance Considerations Agric & Impact Fund Managers – PART II

Tangible and intangible benefits.

Whilst evaluating the costs and benefits of insurance, Investment Managers need to understand how much it will cost to defend a potential regulatory investigation or claim, fund investor claim, employee claim or even a claim by a director the fund. Consider for example what will be the impact on the firm if a claim were to arise, how it will impact reputation, and future capital raising efforts. One should also assess the likelihood of the firm, fund or directors remaining solvent whilst defending a claim without insurance.

It is important to note that IMI product providers tend to promote product specialisation in the IMI space. For example, we randomly selected Liberty Speciality Markets’ as a provider, and they state they have specifically tailored REIT and Venture Capital & Private Equity policy wordings combine Professional Indemnity, Directors’ & Officers’ (D&O) Liability and Crime covers for a broad range of fund and asset managers.

In ascertaining the tangible and intangible costs of insurance, Investment Managers need to understand how much it will cost to defend a potential regulatory investigation or claim, fund investor claim, employee claim or even a claim by a director the fund.

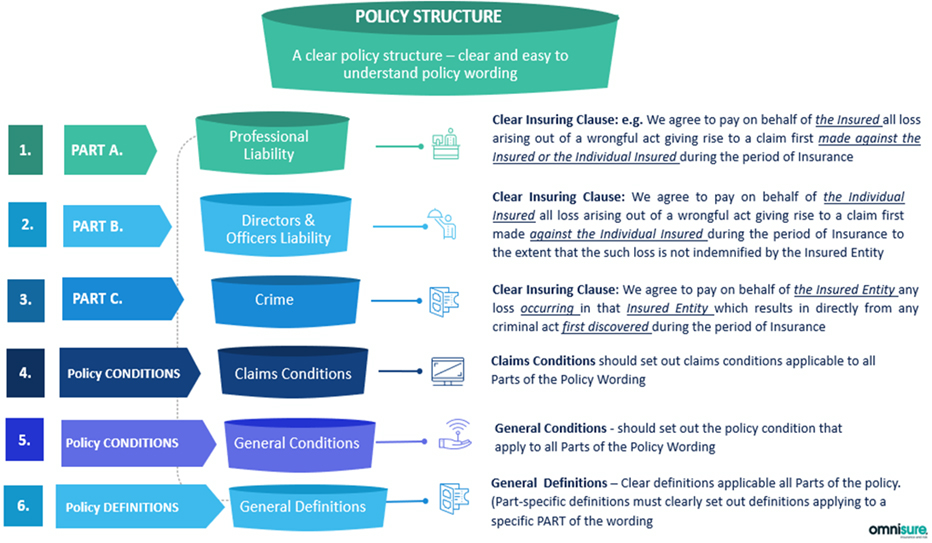

Please see our graphic overleaf on Product Structure. The general definitions need to align with the whole wording, be well drafted (to be clear and easy to understand), with part-specific definitions being well drafted.

See our Foundation Document [1] for certain Annexures to Ch 13 (Insurance Considerations: Agricultural & Impact Fund Managers) called “Insurable Risks” and “What to look for in a good IMI policy” for further information.

See details below of what is covered under the different Parts of a typical IMI wording.

| Cover under Part A Professional Liability [2] |

- Professional Services – includes advisory, marketing and fund raising, investment and fund management services, services provided in the capacity of a trustee or responsible entity and administration, custodial or registry services, relating to investments in connection with an insured fund.

- Civil Liability Insuring Clause – indemnifies insured organisations and insured persons and does not tie to negligence or breach of professional duty.[3]

- Self-Report, Internal Inquiry and Professional Inquiry Costs & Expenses – the costs and expenses of preparing a self-report, participating in an internal inquiry or appearing at an industry-wide inquiry with no requirement for the findings to lead to a claim.

- ASIC Administrative Action – Appeal Costs & Expenses – the costs and expenses of an application or appeal to an administrative tribunal as a result of ASIC suspending or cancelling an AFS licence or issuing a banning order prohibiting an insured person from providing financial services.

- External Dispute Resolution – for claims brought under an ASIC Approved External Dispute Resolution Scheme such as the Credit Ombudsman Service Limited, Financial Ombudsman Service Scheme or the Australian Financial Complaints Authority. Cover is not sub-limited, but the excess will apply to each claim determined or settled under such Scheme.

- Contractual Liability – for liability the insured incurs under an indemnity or hold harmless term of a contract to the extent that such liability results from the insured’s performance of professional services.

- Limitation of Liability Contracts – the insured’s right to claim under Liberty’s IMI policy will not be prejudiced by contracts entered into by the insured which limit the other party’s liability.

- New Disclosure Documents – automatic cover for any claim arising out of the issuing of any prospectus or similar document issued during the policy period which does not exceed certain threshold requirements. For those that do, there is a 90-day window to provide additional information and to agree to any specific terms and conditions Liberty may impose (including additional premium).

- New Funds – to give clients the flexibility to grow their product offering, the definition of insured fund is automatically extended to new funds which do not exceed certain threshold requirements. For funds outside our guidelines there is a 90-day window to provide information about the new fund and to agree to any specific terms and conditions Liberty may impose (including additional premium).

- Cyber (optional) – this optional extension covers cyber liability arising from the performance of professional services, fines & penalties, extortion and privacy breach notification costs.

- Statutory Liability (optional) – this optional extension covers pecuniary penalties and fines an insured is required to pay under statutory civil penalty provisions, provided they are not uninsurable at law or under the relevant statute.

| Extensions (to Part A) include | |||

| · Advancement of Costs & Expenses | · Emergency Expenses | · Spouses, Estates & Representatives | · Change in Control – Run off Cover |

| · Fraud & Dishonesty | · Vicarious Liability | · Continuous Cover | · Intellectual Property Rights |

| · Loss Mitigation & Rectification (optional) | · Costs of Living Expenses | · Joint Ventures | · Proportionate Liability(optional) |

| · Court Attendance Costs | · New Subsidiaries | · Reinstatement (optional) | · Deemed Employees |

| · Public Relations Expenses | · Defamation action | ||

| Covered under Part B Directors’ & Officers’ Liability |

- Defence Costs Paid in Advance – prior to final resolution of a valid claim.

- Self-Report, Internal Inquiry and Management Inquiry Costs & Expenses – costs and expenses of preparing a self-report, participating in an internal inquiry or appearing at an industry-wide inquiry which does not require an allegation of a wrongful act against the insured.

- Public Relations Expenses – costs and expenses in seeking advice from a public relations consultant to protect an insured person’s reputation following negative publicity arising from a wrongful act which has or could reasonably lead to a claim.

- Lifetime Run Off Cover for Former Insured Persons – in the event of a change in control, an unlimited reporting period is provided to former insured persons who have resigned or retired during the policy period, provided that the insured person’s tenure was not involuntarily terminated or terminated due to the change in control and provided no other insurance applies.

- Outside Directorship – this extension, subject to certain limitations, covers the insured person acting in the capacity of a director or officer of an outside entity at the request of the insured organisation.

- Fines & Penalties – worldwide cover (excluding USA) is provided for the fines and pecuniary penalties which an insured person is required to pay provided that the fines and pecuniary penalties are not derived from a reckless act or omission and are not uninsurable at law or under the relevant statute. Under certain conditions, defence costs are also available to challenge the imposition of the pecuniary penalty.

- Additional Side A Limit (optional) – if the limit of liability under Part B is exhausted, this extension provides an additional limit of liability for each director, up to the Additional Side A Limit specified in the Schedule for all Directors.

| Other Extensions (Part B) include | ||

| · Asset & Liberty Expenses | · Court Attendance Costs | · Occupational Health & Safety Defence Costs |

| · Bail Bond & Civil Bond Expenses | · Emergency Expenses | · Personal Tax Liability |

| · Change in Control: · Run-Off Cover | · Extradition Costs | · Company Securities Liability (optional) |

| · Continuous Cover | · New Disclosure Docs | · Cost of Living Expenses |

| · New Funds | · New Subsidiaries | · Employment Practices Liability (Optional) |

| Cover Part C – Crime |

- Insuring Clauses Differ* – note the malicious acts or omissions of an employee in some wordings requires the intent of personal financial gain.

- Care, Custody & Control – the policy covers loss of money, securities or tangible property belonging to an insured organisation or to a client which is in the care, custody and control of the insured organisation.

Other Extension to Part C include:

| · Continuous Cover | · New Subsidiaries | · Court Attendance Costs |

| · Public Relations Expenses | · New Funds |

Private equity and venture capital companies

For Private Equity and Venture Capital companies, the solutions may vary their funds & their portfolio companies. These may range from professional risks for Directors and Officers to Industrial Special Risk for portfolio companies. Some of the most prevalent risks faced by Private Equity managers include:

| · Professional Indemnity | · Transactional Liability |

| · Directors’ & Officers’ Liability | · Representations and Warranties |

| · Crime | · Crisis Management |

| · Commercial Office Package for portfolio companies | · Insurance due diligence |

| · Industrial Special Risks for portfolio companies | · Employee Practices liability |

| · Public Offerings of Securities |

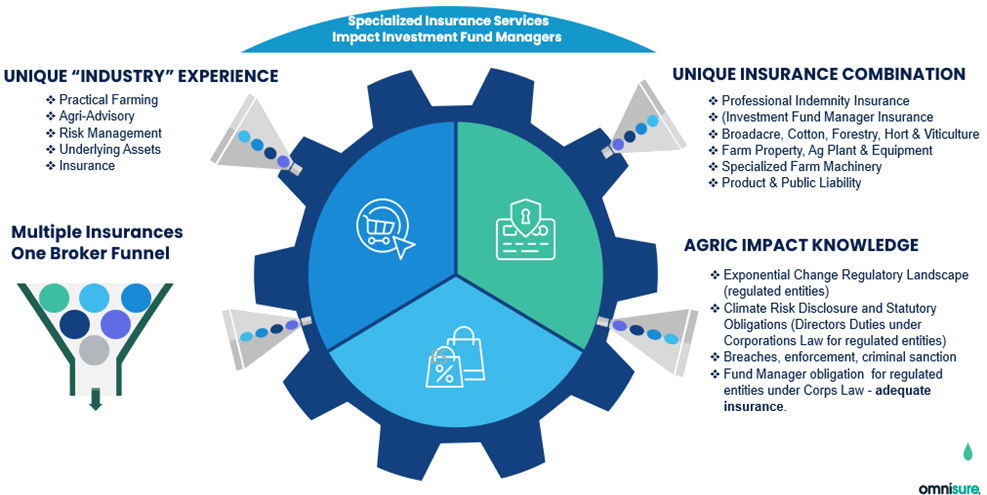

| Omnisure’s unique proposition |

Omnisure’s unique proposition for alternative investment managers is that we cater to the needs of:

- real property, agricultural and property physical asset fund managers, as well

- as IMI Insurance and specialist expertise in the underlying physical asset insurance market space.

Some insurance advisors will only provide financial lines insurance (IMI cover) without catering to the needs of the underlying asset protection in alternative investment funds. This leaves a gap in advice to fund manager.

Omnisure expertise includes deep insurance experience in:

- crops (whilst growing, or upon harvesting and lying in the paddock, harvested, baled etc).

- agricultural machinery; fixed infrastructure both below and above ground; buildings, homesteads, sheds, stored hay, grain silos, irrigation equipment; specialised farm vehicles (both registered and unregistered); and

- commercial property (commercial, industrial, residential and specialised real property; and [4] full spectrum of liability covers.[5]

In assisting agricultural investment fund managers secure the right protection, we work with clients to understand your business by following the steps set out in the Infographic below.

Step 1: Insurance Product Audit

In conjunction with step 2 we will review your existing insurance product range at the same time as learning more about your business. We do this to ascertain whether insurance products address the risks relevant to your business.

Step 2: Understand Your Business, Understand Your Exposures

Review your business operations in conjunction with step 1, review your claims history (if any) and risk management procedures to get an understanding of your business and risk management practices. We will have regard to any proposed changes to the business.

Step 3: Risk Gap Analysis

We can help you evaluate gaps in cover and whether the amount of cover is sufficient. We help you assess ‘the maximum liability’ that has a realistic potential to arise based on our agricultural insurance experience. ASIC has a recommended process for this which is for fund managers make a reasonable estimate of the following factors:

- The maximum exposure (‘worst loss scenario’);

- The number of claims that could arise from a single event (potential for multiple claims); and

- The number of claims that might be expected during the policy period,

and for regulated entities help you meet your requirements under ASIC’s minimum requirements as per RG 126

Step 4: Product Selection

We help assess whether product selection is appropriate for the insurance risks you face and whether relevant risks have been considered

Step 5: Recommendations

We help you assess whether existing product selection is appropriate for the insurance risks you face. We make recommendations on product selection based on cover, price, insurer financial strength and our experience of claims performance of insurers. We normally do this relative to the deductibles based on your feedback on risk appetite, balance sheet strength, your risk tolerance and ability to withstand loss and/or to retain some risk.

Click here to see Ch 13 – Part I.

End

[1] Our Foundation Document is the original full text version of “ESG Discussions – Introductory articles on emerging exposures, risk mitigation & insurance risk transfer” for clients of Omnisure, compiled by Martin Birch. Register on our website for a full copy.

[2] Not all IMI policies offer exactly the same covers. Covers, additional benefits, conditions & exclusions, limits & sub-limits differ between insurers (as is the case for all classes of insurance). The examples quoted here refer to the Liberty Speciality Markets IMI wording as at 2022.

[3] Civil liability insurance policy vs Professional indemnity insurance: In terms of professional indemnity insurance, a ‘civil liability’ wording is the widest available form of cover and wider than the usual ‘negligence’ or ‘errors and omissions’ wordings. This wording will cover situations where a policyholder may be held liable for financial loss without having to be proven to be negligent.

[4] The author has experience is running the agricultural insurance business for a global primary insurer, co-founded an agricultural underwriting agency, a discretionary farmers mutual fund in Australia, and ran a commercial/industrial property business unit in Nedcor Investment Bank in South Africa.

[5] Including aircraft landing strips on farms, drone and unusual exposures including insurance advice on policy coverage in relation to esoteric subject matter such as the escape of fire on farms, liability claims arising from overflowing of waterways or run-off on cultivated sloping land, unregistered vehicles exposure, injury caused by or to livestock, horse riding accidents, all-terrain-vehicles (ATV) personal injury exposures.

Please contact Martin Birch for a copy of the full-text Foundation Document at martin.birch@omnisure.com.au