Chapter 13. Insurance Considerations –

Agricultural & Impact Fund Managers Part I

Introductory articles on emerging exposures, risk mitigation

and insurance risk transfer for clients of Omnisure.

A compendium of introductory ESG articles on emerging exposures, risk mitigation and

insurance risk transfer for clients of Omnisure with claims examples.

Martin Birch – March 2022

![]()

Ch 13. Insurance Considerations: Agricultural & Impact Fund Managers Part I

In the preceding chapters of this Omnisure compendium of ESG resources, we discussed the risk presented by breach of ESG statutory duties under existing local laws. Certain statutory ESG obligations are subject to enforcement by corporate regulatory authorities and may carry criminal sanctions.1 We considered the risk of incurring penalties under the various laws and regulations, citing certain relevant legal opinions. Against that backdrop, in this chapter we explore:

- some options available to directors and officers to protect themselves from legal risks, and

- how a skilled insurance broker with deep experience in the physical agricultural market could add value in the preparation of a holistic insurance programme for agricultural fund managers

Investment Managers, their directors and senior managers carry the risk of corporate liability exposure arising out of the management of their entities and funds. Please see our Foundation Document 2 for commentary on Insurers and the ESG Landscape, a brief Synopsis of Alternative Asset Managers in agriculture, and commentary on the financial lines risk class in Australia. In this Chapter we are concerned with insurable risks and the availability of insurance products to protect investment fund managers from ESG exposures and fund manager risks.

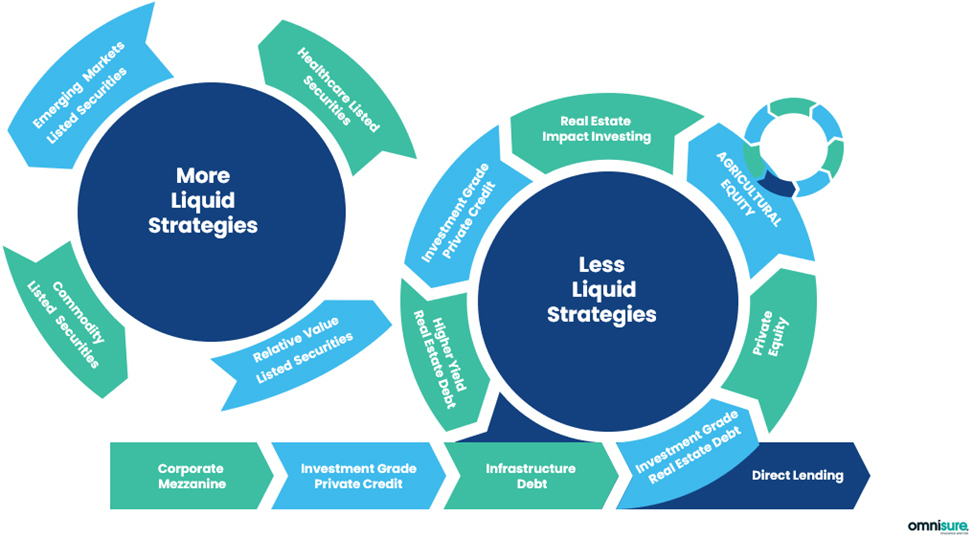

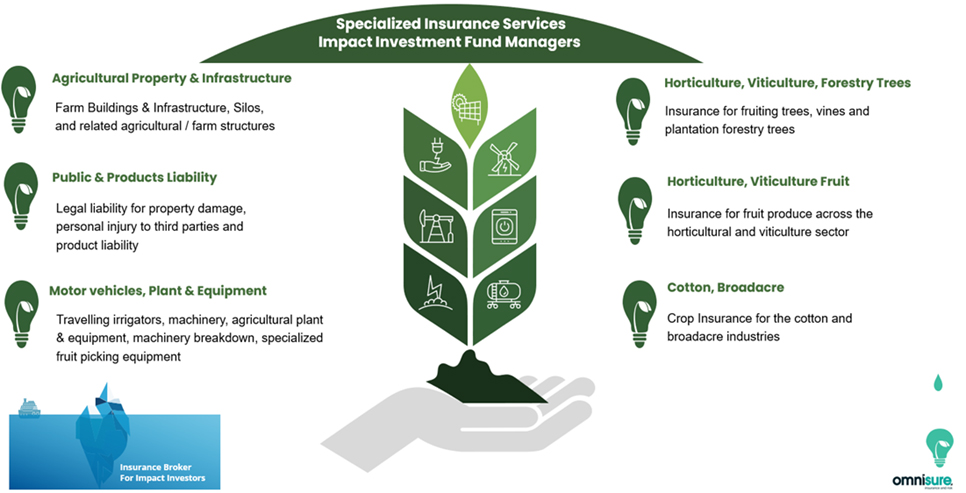

Impact Investment Fund Managers often invest in less liquid, physical assets. Agriculture normally involves investment in annual or multi-year production assets like crops and fruiting trees, as well as farm buildings and infrastructure, all of which are insurable. In some cases the law requires investment firms to ensure that they have taken out adequate and appropriate insurance to protect the interests of investors.

Relevant Insurance Products for Ag Funds

Financial Lines class of insurance

The class of insurance most relevant to the exposures discussed in this chapter fall under the broad heading of Professional Indemnity insurance. There are a range of professional indemnity products available in Australia and abroad , such as IMI and transaction insurance (in relation to any M&A activity). However, there are other important insurance products relevant to agricultural asset managers.

Other classes of insurance (see Infographic below for agriculture)

What is Investment Management Insurance?

The business occupation of Investment Fund Managers falls within the class of insurance designed for the Professional Services sector. Unsurprisingly the product designed for the fund management industry is called Investment Management Insurance (“IMI”). Read more about the legal landscape of managed investment schemes, responsible entities and allied service providers here, and (more relevantly), agricultural property funds here.

The potential for claims

Investment Managers Insurance has been developed to take into consideration these complex requirements in an effective and efficient manner by combining the following broad categories of cover into one policy: Professional Indemnity cover; Directors & Officers Liability cover; and Crime cover.

Covered exposures

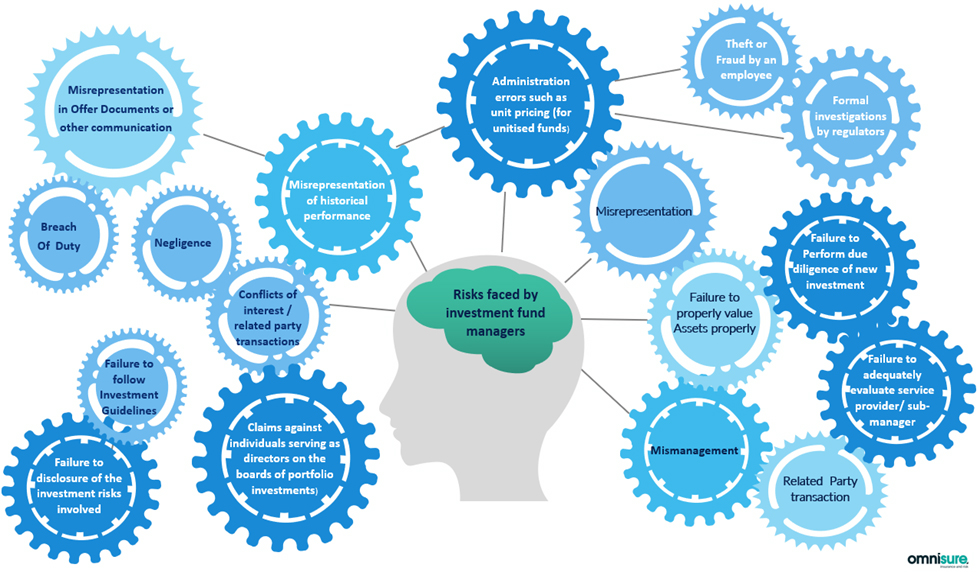

The typical coverage provided under an Investment Managers Insurance include some of the following matters, each of which presents a discrete risk to managers:

- Breach of investment management contracts;

- Mismanagement or failure to supervise (for example where a Responsible Entity appoints a rogue portfolio manager);

- Non fraudulent misrepresentation (for example, failure to clearly specify tax implications of investments).

- Liabilities that arise under the Corporations Act 2001 (Cth)3 such as:

the statutory responsibilities set out for the Responsible Entity under Section 601FC of the Corp’s Act:- i)the liability of the Responsible Entity for the acts and omissions of its external custodian or its auditors, and

- ii)the responsibility of Directors to ensure that the terms of the insurance covers effected by the Responsible Entity are adequate. See ASIC Regulatory Guide RG 259.89

What type of industry sectors can be covered?

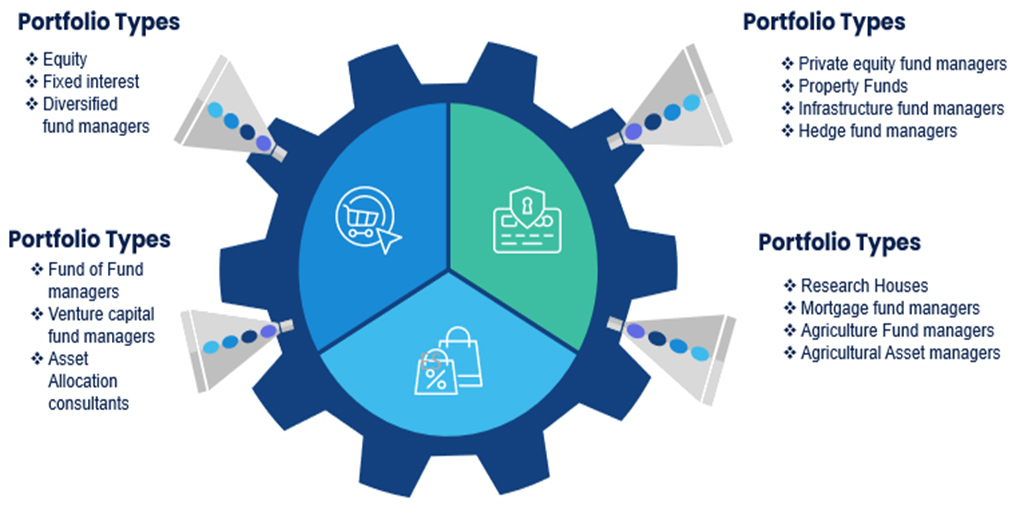

The IMI policies available in Australia usually cover managers across a broad range of portfolio types:

Why the need for an IMI policy?

A tailored IMI policy therefore provides protection to both the organisation and individuals against claims from acts, errors, breaches of duty or theft of funds while conducting investment management services. Investment Managers & their directors/officers can be susceptible to lawsuits, regulatory proceedings, or written demands by disgruntled investors or third parties. Directors and senior managers can be held personally responsible for an exposure arising out of the management of their entities and funds.

Investment Managers Insurance is tailored to respond to claims frequently encountered by:

- investment managers;

- responsible entities.

- investment trusts or funds; as well as

- the directors and officers of these entities.

Cover for ‘financial loss’ versus cover for other ‘costs’ related to the claim

The award of damages as compensation for a claim is one part of the total cost. Investment Management Insurance offers protection if a claim is to arise, covering a large amount of costs. For most policies these include:

- legal and court related costs;

- public relations;

- theft or scam;

- investigative related expenses;

- damages and compensation; and

- appearance at inquiries.

What usually isn’t covered?

The policy wording exclusions, the excess you need to pay, and the limits of liability can vary greatly depending on your insurer. Policies generally won’t include cover for:

- known claims and circumstances;

- insured vs. insured claims;

- fraud and dishonesty;

- prior and pending litigation; and

- claims made by major shareholders.

| Examples of risks faced by investment managers |

| Examples of risks faced by investment managers |

Please see Part II of this Chapter 13 for further discussion on tangible and intangible costs and benefits of IMI insurance, technical specification, product structure and more.

1 See ESG ‘Corporate Governance’ in Ch 2: Environmental Protection & Biodiversity Conservation Act 1999, Commonwealth National Greenhouse & Energy Reporting Act 207, Traditional Owner settlement Act 2001 Vic, Fair Work Act, Commonwealth Modern Slavery Act, Workplace Gender Equality Act 2021.

2 Our Foundation Document is the original full text version of “ESG Discussions – Introductory articles on emerging exposures, risk mitigation & insurance risk transfer” for clients of Omnisure, compiled by Martin Birch. Register on our website for a full copy.

3 The term ‘managed investment scheme’ (MIS) is defined in Section 9 of the Corporations Act 2001 External Link. Management investment schemes are regulated by the Australian Securities & Investments Commission (ASIC). See Chapter 5C of the Corporations Act 2001 (Cth).

Please contact Martin Birch for a copy of the full-text Foundation Document at martin.birch@omnisure.com.au