We are optimists – We believe in the future of Australian food and agriculture. We are optimistic about drought resilience research activities and innovation hubs to boost resilience in Australian landscape. We are optimists and we believe there is a way. And we want to be part of the journey supporting clients with the latest tools in risk management advice and insurance products.

We have experience – We are a home-grown Australian insurance intermediary business. We have deep connections with primary insurers in the insurance landscape developed over 20 years of practice.

We understand agriculture – We have people in our group that have deep domain experience in agricultural underwriting, pricing, products and importantly in insurance broking. Within our group we have people that have worked with global reinsurance companies, started agricultural mutual funds, agricultural underwriting agencies, who have held delegated claims and underwriting authority. What this means for you is that we can bring deep experience in this sector to you when we work with you. We’re not perfect – but we’re not far away.

What we do – we build continuous sustainable operations that allow us to align strategically with clients that embrace us as valuable partners and trusted advisors with high confidence, for their sustained future. And we have strong focus on our own internal business culture – one that builds a business in which we lead from the front. Where our staff are motivated, seek to engage, develop and grow whilst forming sincere and enduring relationships with stakeholders across the insurance value chain, from underwriters to insured customers.

In the final analysis, we provide increased security and risk confidence to help our customers sleep easy.

Our focus – is the future of risk in food and agriculture. Our mission to revolutionise the future of risk management through trust and technology, with absolute intent on delivering client-centred insurance recommendations. We seek to provide our clients with the best solutions today for a better tomorrow.

Our goal – is a sustainable, prosperous and digitally enabled insurance services and risk mitigation advice, in support of a vastly improved underwriting future for the food & agricultural sector. We dream of a cleaner, digitally enabled sector with a food-focussed insurance proposition backed by like-minded insurers who to wish to conduct insurance business in food and agriculture.

So-called ‘Blue’ solutions as an apt example, where:

- Seaweed can add 10% to the world’s present supply of food using just 0.03% of the oceans’ surface.

- Seaweed and microscopic algae is responsible for 50% of photosynthesis on Earth.

And by 2050, seaweed production could absorb 135m tons of CO2 a year and 30% of all nitrogen entering the oceans from land-based pollution.

We aim to be part of exciting solutions of the future as a provider of industry-specific risk advice and insurance solutions using the large number of global insurers with whom we have relationships and with whom we deal, in our chosen markets.

Sector specific experience

We have people with deep domain experience in the agricultural sector (from underwriting, claims to broking) who can assist in interpreting policy wordings, understand the cover provided, know where to get appropriate insurance cover and work with underwriting agencies providers to answer key questions.

Product management experience

We have people with validated experience who have been product managers in this sector, managing insurance portfolios excess of $100 million revenue. This experience covers the drafting of policy wordings, delegated underwriting authority, and delegated claims authority specifically in the sector. What this means for our clients in that we can facilitate increased confidence by obtaining clearer understanding of the indemnity provisions in policy wordings. And importantly, we can provide expert support if you have a claim.

Global Insurance Network

Omnisure is a member of the Steadfast Group, Australia’s largest insurance broker network in Australia & New Zealand. Our global insurance Network means that our brokers can access more than 150 insurers across the globe. We can search for the right cover at the right price.

Australia exports about 72% of the total value of agricultural, fisheries and forestry production, which in 2022–23 was an estimated $98 billion. In support of this vision the Federal Government has established a commercially focussed research sector investing in federal agencies which are driving innovative projects and programs, increasing trade and market access opportunities, encouraging innovation, enhancing Australia’s international standing on sustainable agriculture and climate action, and maintaining our world-class biosecurity system to protect our agricultural industries.

AgriFutures Australia is one of 15 Research and Development Corporations (RDCs) that service the Research, Development and Extension (RD&E) needs of Australian rural industries. They represent the research needs for 13 thriving rural industries (chicken meat, rice, honey bee and pollination, ginger, tea tree oil, pasture seeds, export fodder, thoroughbred horses, kangaroo, buffalo, deer, goat fibre and ratite), delivering research and innovation that aims to give our farmers and producers real returns, as well as prepare them to thrive into the future.

The RDCs are funded primarily by statutory R&D levies (or charges) on various commodities, with matching funding from the Australian Government. To expand Australia’s rural R&D efforts, the government matches expenditure on eligible R&D, generally up to 0.5% of the determined industry gross value of production. RDCs are accountable to both industry and government.

The food, farm and fibre industry is a pillar of the Australian economy. More than $2 billion invested into research and development (R&D) activities annually. That investment is paying dividends. As at 2023 ABARES (Australian Bureau of Agricultural and Resource Economics and Sciences) estimated that every $1 of R&D investment generates over $7 in gross value added for farmers. Innovation in the Ag space is booming. Australia’s agricultural sector is dreaming big when it comes to the future of farming with exciting research projects making that dream a reality. Examples include ‘next generation wool harvesting, clever cotton, optimised pollination efficiency by expanding the roster of available berry pollinators, Honeybee AI, accelerating heifer genomics. R&D is fundamental to the delivery of these new technologies, and has a promising future with investment from the public and private sector increasing at a steadily rate over the past 10-years.

- There are 13 distinct industries that fall under the research and innovation auspices of AgriFutures Australia. AgriFutures produces research and innovation outcomes that aim to give farmers and producers real returns, as well as prepare them to thrive into the future. These levied industries include Chicken Meat, Export Fodder, Thoroughbred Horses, Honey & Bee Pollination, Rice, Ginger, Tea Tree Oil, Pasture Seeds, Kangaroo, Buffalo, Deer and Goat Fibre (Mohair).

The AgriFutures Emerging Industries Program helps grow up-and-coming emerging agricultural industries through targeted research and development. Funded research explores opportunities for growth, and the program invests in skills-development for emerging industry leaders with a goal to sustainably grow developing rural industries and help them reach new markets.

Emerging industries fall into one of three categories:

- Emergent: emergent industries are represented by a small number of producers and are sometimes in their trial phase. The potential or feasibility of the emergent industries needs to be explored and mapped.

- Scaling: scaling industries have successfully established themselves in markets and have addressed some industry issues and opportunities. They face ‘step change’ and economies of scale challenges.

- Growth: growth industries have overcome initial industry growth challenges and now need support to manage rapid growth and demand for their product.

Farmers and producers from emerging industries are not required to pay primary industry levies and charges to fund R&D. Instead, AgriFutures Australia receives funding from the Australian Government to invest into driving the growth or development of emerging, high-potential rural industries. The Australian food and agribusiness industry is well led, the funding of research and commercialization is well structured, and it has great potential. We want to be the pre-eminent risk partner for sector’s future.

- So how can we help. Our food and agribusiness division provides industry-focused insurance risk advice and claims advocacy services to clients across industries. Professional indemnity insurance is second nature to us. We have people with deep domain experience in the agricultural sector who can assist in interpreting wordings, understand the cover provided, know where to get appropriate insurance cover and work with underwriting agencies providers to answer key questions. We can facilitate increased confidence by obtaining clearer understanding of the indemnity provisions in policy wordings. And importantly, we can provide expert support if you have a claim.

Levied Industries sector

If you buy, export, produce, process or sell Australian agricultural produce yourself, or on behalf of another person, you may have to pay a levy or charge. Industry levies and charges fund research and development (R&D), marketing , biosecurity activities such as plant and animal health programs, biosecurity emergency responses and residue testing activities that benefit industry. In many cases, and within certain prescribed limits, the government matches the R&D component of levies on a dollar-for-dollar basis.

So how can we help. Our food and agribusiness division provides industry-focused insurance risk advice and claims advocacy services to clients across industries. Professional indemnity insurance is second nature to us. We have people with deep domain experience in the agricultural sector who can assist in interpreting wordings, understand the cover provided, know where to get appropriate insurance cover and work with underwriting agencies providers to answer key questions. We can facilitate increased confidence by obtaining clearer understanding of the indemnity provisions in policy wordings. And importantly, we can provide expert support if you have a claim.

In addition to the levy-focused investment activities that are our core work, Hort Innovation also forges partnerships with a broad range of co-investors to deliver investments through our Hort Frontiers arm. Hort Frontiers was established by Hort Innovation to address a range of long-term and complex issues that are critical to the future of Australian horticulture

The government has a Statutory Funding Agreement that it has entered into with Hort Innovation, allowing it to pass these collected levies on to Hort Innovation.

Hort Innovation has the responsibility to work with each horticulture industry to make strategic investments in R&D and marketing programs, specific to their needs and priorities. All levy investments involve consultation with and advice from industry, delivered through industry-specific Strategic Investment Advisory Panels (SIAPs).

Once money is invested, the Australian Government contributes to the costs of R&D investments by making a contribution using public money. Investments from marketing levies do not attract the same contribution from the Australian Government.

The benefits of the investments that are made go directly back to the industry from which the levy was collected, to support increased productivity, profitability and competitiveness of the sector.

As well as statutory levies, Hort Innovation also invests voluntary levies on behalf of some horticulture industries, through a collective industry fund (CIF) process. These voluntary CIF levies are not collected by the Australian Government, but by a third party nominated by the industry. The CIF levies follow the same investment process as statutory levies, being entrusted to Hort Innovation and attracting the Australian Government contribution for R&D investments.

You can visit Hort Innovation’s levy fund pages to learn more about the industry-specific funds through which strategic levy investments occur. These pages include details of each levy fund’s Strategic Investment Plan (SIP), which sets the roadmap for decision-making within the levy fund, as well as information on the fund’s SIAP. Each of the levy fund grower pages gives you valuable information, including:

✔ Details and updates of ongoing and completed investment projects

✔ Financial reports and investment documents relating to your levy fund

✔ Outputs of investment projects and resources that you can use

✔ Upcoming events

✔ Consultation information for your levy fund

✔ Contact details for Industry Service & Delivery Managers and Marketing Manager

The work done at Hort Innovation is essentially divided into two funding models – strategic levy investment and the Hort Frontiers strategic partnership initiative. Use their website to discover key information on where funding for these investment activities come from, and how investment decisions are made. You’ll also find important documentation, including annual reports and other investment-related documents.

Industry-specific Strategic Investment Plans (SIPs) outline the key priorities for investment in each levy industry. Each SIP has been created through close consultation with industry, to ensure it represents the balanced interests and opportunities for that industry.

The very important function of each SIP is to ensure that levy investment decisions align with industry priorities. Australia has a world class agricultural infrastructure sector, and we add value in providing insurance & risk advice in our chosen markets.

The Cherry sector’s Strategic Investment Plan provides a roadmap to guide Hort Innovation’s investment of cherry industry levies and Australian Government contributions, ensuring investment decisions are aligned with industry priorities. The are four outcome areas of the Cherry SIP. They cover themes under which programs and investments will be focused. These initiatives spawn new economic activity in the agricultural food production space, and this is where we can add value using our skill set in insurance and risk management.

Demand remains the primary focus with a goal to improve market access and develop new markets. This is followed by productivity, supply and sustainability, which requires focus on innovative orchards and responding to environmental change and climate variability.

In summary, the Australian food and agribusiness industry is well structured, and it has great potential. We want to be the pre-eminent risk partner for sector’s future.

So how can we help. Our food and agribusiness division provides industry-focused insurance risk advice and claims advocacy services to clients across industries. We have 17 years agricultural insurance experience. We have people with deep domain experience in the agricultural sector who can assist in interpreting wordings, understand the cover provided, know where to get appropriate insurance cover and work with underwriting agencies providers to answer key questions. We can facilitate increased confidence by obtaining clearer understanding of the indemnity provisions in policy wordings. And importantly, we can provide expert support if you have a claim.

Our insurance Partners – Global Market Access

With access to over 150 global insurance products we provide customised agricultural insurance solutions for your large or corporate farm. Australian farms are highly diversified, and our experts have global market access and knowledge to manage your risk. We focus on large complex farming operations, and we have 17 years agricultural insurance experience. We combine our experience in agricultural insurance with global market access to provide correct insurance solutions for your business.

Co-operatives, in particular, play a significant role in the Australian agricultural and food landscape by pooling resources, collaborating and adding value to their produce by researching and establishing processing facilities for raw product. Some of our people have experience in setting up mutual funds for primary producers in Australia, and have deep underwriting, claims and insurance portfolio management experience. What this means for you is that we have depth when we engage with customers in relation to risk and insurance requirements in this sector.

So how can we help. Our food and agribusiness division has experience in Association liability insurance and agricultural cooperatives. We provide industry-focused insurance risk advice and claims advocacy services to clients across industries. We have people with deep domain experience in the agricultural sector (including establishing discretionary mutual funds for farmers) who can assist in interpreting wordings, understand the cover provided, know where to get appropriate insurance cover and work with underwriting agencies providers to answer key questions.

We can facilitate increased confidence by obtaining clearer understanding of the indemnity provisions in policy wordings. And importantly, we can provide expert support if you have a claim. We are farm package experts and can provide insight on small details and covers in policy wordings, such as protection for tree breaks on your farm.

As an insurance intermediary with an agricultural and farming heritage within our food and agribusiness practice, we seek to work with enterprises generating ideas, delivering insight, and making the connections that help them capitalize on technological change and shape a cleaner, more competitive future.

So how can we help. Our food and agribusiness division provides industry-focused insurance risk advice and claims advocacy services to clients across industries. Professional indemnity insurance is second nature to us and we have a large and growing practice in this area. We have people with deep domain experience in the agricultural sector who can assist in interpreting wordings, understand the cover provided, know where to get appropriate insurance cover and work with underwriting agencies providers to answer key questions. We can facilitate increased confidence by obtaining clearer understanding of the indemnity provisions in policy wordings. And importantly, we can provide expert support if you have a claim.

The AgXelerate Program consists of two cohorts, addressing different Technology Readiness Levels (TRL). As they graduate from the program, develop and commercialise their cutting-edge technologies, they could unwittingly face third party claim exposures and claims – ranging from misrepresentation & contractual breaches. They could be exposed to professional indemnity, directors & officers’ liability, and information technology liability claims for wrongful acts in their pursuit of funding opportunities – as well public liability claims. We can provide expert insurance advice to identify and place appropriate insurance to suit each setting.

So how can we help. Our food and agribusiness division provides industry-focused insurance risk advice and claims advocacy services to clients across industries. Professional indemnity insurance is second nature to us. We have people with deep domain experience in the agricultural sector who can assist in interpreting wordings, understand the cover provided, know where to get appropriate insurance cover and work with underwriting agencies providers to answer key questions. We can facilitate increased confidence by obtaining clearer understanding of the indemnity provisions in policy wordings. And importantly, we can provide expert support if you have a claim.

So how can we help. Our food and agribusiness division provides industry-focused insurance risk advice and claims advocacy services to clients across industries. Professional indemnity insurance is second nature to us. We have people with deep domain experience in the agricultural sector who can assist in interpreting wordings, understand the cover provided, know where to get appropriate insurance cover and work with underwriting agencies providers to answer key questions. We can facilitate increased confidence by obtaining clearer understanding of the indemnity provisions in policy wordings. And importantly, we can provide expert support if you have a claim.

Why is soil carbon so important.

It all starts with photosynthesis according to CSIRO. Carbon is captured from the atmosphere by plants, which convert carbon dioxide into plant material. When plants die, or components senesce, carbon is added to the soil and although much goes back to the atmosphere the size of the soil carbon pool may be increased.

Soil organic carbon (SOC) is an important indicator of soil quality and agronomic sustainability. It influences the physical, chemical and biological properties of soil quality, leading to effects on nutrient and waste cycling, water holding capacity, and biodiversity. Building and maintaining organic matter helps ensure healthy and productive soil systems and has the added bonus of removing carbon dioxide from the atmosphere, storing it in the soil and reducing greenhouse gas emissions.

We have an interest in supporting farmers and agricultural producers who are already participating in the Australian in carbon markets or wish to do so. We have an interest in contributing towards diversifying agricultural participation in carbon markets and minimising barriers that prevent these opportunities from being realised. Over the past 30 years, carbon markets have emerged in multiple countries, offering agricultural producers with new opportunities to grow and diversify their businesses.

So how can we help. Our food and agribusiness division provides industry-focused insurance risk advice and claims advocacy services to clients across industries. Professional indemnity insurance is second nature to us. We have people with deep domain experience in the agricultural sector who can assist in interpreting wordings, understand the cover provided, know where to get appropriate insurance cover and work with underwriting agencies providers to answer key questions. We can facilitate increased confidence by obtaining clearer understanding of the indemnity provisions in policy wordings. We strive to provide insurance advice to customers in carbon markets that can provide a safe harbour for insurable risks in our chosen markets. And importantly, we can provide expert support if you have a claim.

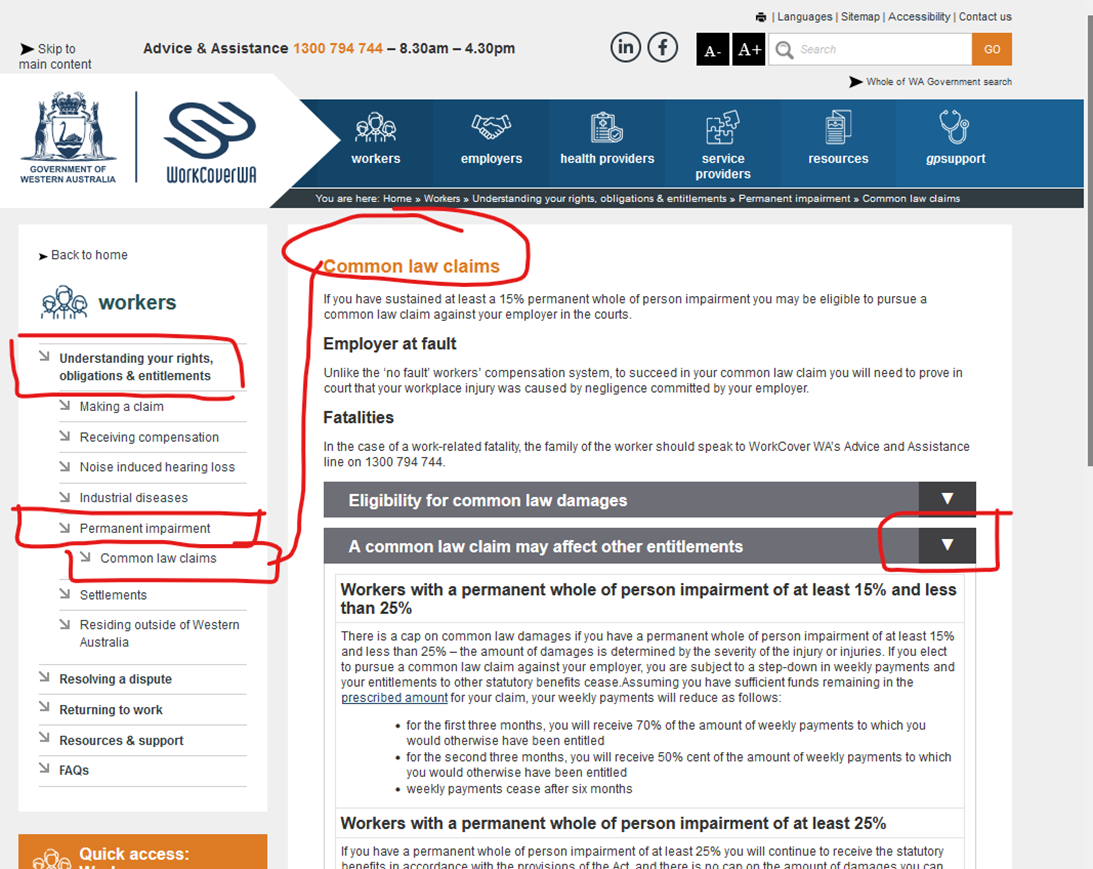

Agri-Associations – professional associations, member-based organisations, agricultural shows, and more. Peak professional organisation (not-for-profit or otherwise) for people involved in the use and development of food and agriculture in Australia & New Zealand. Association Liability Insurance has several cover sections. The professional indemnity section offers cover for claims alleging a breach of duty in the conduct of the association’s services. The other sections cover a range of operational risks including allegations of mismanagement (officers’ liability or directors & officers’ liability), employment-related claims, crime losses, tax audit and more.

Most policy sections provide cover for legal costs and compensation due to allegations that you’ve caused someone else loss. Some policy sections compensate you for losses you suffer.

So how can we help. Our food and agribusiness division provides industry-focused insurance risk advice and claims advocacy services to clients across industries. We have existing agricultural association clients and we have association liability experience. We have expert staff with deep domain experience in the agricultural sector who can assist in interpreting wordings, understand the cover provided, know where to get appropriate insurance cover and work with underwriting agencies providers to answer key questions. We can facilitate increased confidence by obtaining clearer understanding of the indemnity provisions in policy wordings. And importantly, we can provide expert support if you have a claim.

The large of policies that might be required is large and can include association liability insurance and public liability. Public liability covers injury or property damage to patrons arising out of the conduct of the show which is normally at the show ground premises.

Association Liability Insurance has several cover sections. The professional indemnity section offers cover for claims alleging a breach of duty in the conduct of the association’s services. The other sections cover a range of operational risks including allegations of mismanagement (officers’ liability or directors & officers’ liability), employment-related claims, crime losses, tax audit and more. Most policy sections provide cover for legal costs and compensation due to allegations that you’ve caused someone else loss. Some policy sections compensate you for losses you suffer.

So how can we help. Our food and agribusiness division provides industry-focused insurance risk advice and claims advocacy services to clients across industries. Professional indemnity is second nature to use and we have association liability wording experience. We have staff with deep domain experience in the agricultural sector who can assist in interpreting wordings, understand the cover provided, know where to get appropriate insurance cover and work with underwriting agencies providers to answer key questions. We can facilitate increased confidence by obtaining clearer understanding of the indemnity provisions in policy wordings. And importantly, we can provide expert support if you have a claim.

The professional indemnity insurance usually provides cover for breach of research integrity. Breaches of research integrity occur when there is a deviation from accepted practice. Research misconduct describes a serious deviation from accepted practice and the deviation is intentional, reckless, or negligent.

- Types of research integrity breaches that may constitute research misconduct include:

- Fabrication – Making up data, source material, methodologies or findings, including graphs and images.

- Falsification- Manipulating, changing or omitting data without acknowledgement. This includes changes to source material, methodologies, findings, graphs or images. Changes and omissions lead to inaccurate findings or conclusions.

- Destruction of research records – Destroying one’s own or another’s research data or records to avoid the detection of wrongdoing. Or a destruction that contravenes the applicable agreement, policy, law, regulation or standard.

- Plagiarism – Presenting and using another’s work as one’s own, without appropriate referencing. Or without gaining permission, when permission is required. Another’s work includes the following, and can be either published or unpublished:

- theories

- concepts

- data

- source material

- methodologies

- findings

- graphs

- Redundant publications – Republishing one’s own published work or data, without acknowledging the source or justification. This republication could be in the same or another language.

- Invalid authorship – Listing an author who has not contributed sufficiently to take responsibility for intellectual content. Or agreeing to be listed as an author, when there was little or no material contribution.

- Inadequate acknowledgement – Failure to appropriately recognise the contributions of others. Recognition must be consistent with their respective contributions. And with the authorship policies of relevant publications.

- Mismanagement of conflict of interest – Failure to manage any real, potential or perceived conflict of interest. These should be managed using the University’s policy on conflict of interest in research.

- Misrepresentation in a research proposal – Providing incomplete, inaccurate or false information in a grant or award application. It includes misrepresentation in related documents, such as a letter of support or a progress report.

- Mismanagement of research funds – claims alleging a breach of professional duty in the provision of competent advice and/or provision of professional services for a fee.

https://www.csiro.au/en/research/animals/livestock/Ceres-Tag

Virtual fencing – eShepherd™ is a solar powered, GPS enabled, livestock neckband that enables you to remotely track, manage, fence and move your livestock around your farm using virtual boundaries or fences. Simply draw your virtual fence anywhere on your property and your cattle learn to move with and remain within the virtual barrier.

Commercial pain relief innovation for sheep – With supporting research from SCIRO, pain relief options for lambs undergoing castration and/or tail docking are now available to producers in Australia and New Zealand. Working Numnuts®, 4C Design, Meat & Livestock Australia and Australian Wool Innovation they are testing and validating a targeted local anaesthetic delivery system for farmers to use when tail docking and castrating their lambs.

So how can we help researchers.

We have existing clients in the agricultural innovation, investment and AgriTech space. We have people with deep domain experience in the agricultural sector who can assist in interpreting wordings, understand the cover provided, know where to get appropriate insurance cover and work with underwriting agencies providers to answer key questions. Professional indemnity insurance is second nature to us. As research moves through to its start-up phase, to commercialisation and capital raising stages, we can facilitate increased confidence by obtaining clearer understanding of the indemnity provisions in policy wordings. And importantly, we can provide expert support if you have a claim.

We see opportunities in the food supply chains of the future. We seek clients who participate in research with a common vision of a kinder, better future. Smart production of livestock genetics, helping cattle combat microbes, with ‘more genetics’ and ‘less antibiotics’ to improve the health of our animals and people.

As research moves through to its start-up phase, to commercialisation and capital raising stages, we can facilitate increased confidence by obtaining clearer understanding of the indemnity provisions in policy wordings. And importantly, we can provide expert support if you have a claim.

So how can we help.

We want to work with you to ensure that insurable exposures are sterilised with appropriate professional indemnity insurance, or information technology liability insurance, and other exposures are minimized through enterprise risk management plans. Research misconduct does not include honest errors or differences in academic judgement. We see our future as risk advisers, with insurance advice playing a supportive role. We have already started this journey.

Our food and agribusiness division provides industry-focused insurance risk advice and claims advocacy services to clients across industries. We have people with deep domain experience in the agricultural sector who can assist in interpreting wordings, understand the cover provided, know where to get appropriate insurance cover and work with underwriting agencies providers to answer key questions. We can facilitate increased confidence by obtaining clearer understanding of the indemnity provisions in policy wordings. And importantly, we can provide expert support if you have a claim.

So how can we help. Our food and agribusiness division provides industry-focused insurance risk advice and claims advocacy services to clients across industries. We have people with deep domain experience in the agricultural sector who can assist in interpreting wordings, understand the cover provided, know where to get appropriate insurance cover and work with underwriting agencies providers to answer key questions. We can facilitate increased confidence by obtaining clearer understanding of the indemnity provisions in policy wordings. And importantly, we can provide expert support if you have a claim.

Fully electrically and digitally controlled, our systems are safer for operators and the environment. Application is kept on-target, and actionable reporting helps you refine pesticide and chemical use. So how can we help. We understand the farm pack market in Australia. We have expert staff who can assist in interpreting wordings, understand the cover provided, know where to get appropriate insurance cover and work with underwriting agencies providers to answer questions. We can facilitate increased confidence by obtaining clearer understanding of the indemnity provisions in policy wordings. And importantly, we can provide expert support if you have a claim.

So how can we help. Our food and agribusiness division provides industry-focused insurance risk advice and claims advocacy services to clients across industries. We have people with deep domain experience in the agricultural sector who can assist in interpreting wordings, understand the cover provided, know where to get appropriate insurance cover and work with underwriting agencies providers to answer key questions. We can facilitate increased confidence by obtaining clearer understanding of the indemnity provisions in policy wordings. We strive to provide insurance advice to customers in autonomous agriculture and digital information technology providers, that could provide a safe harbour for insurable risks, in our chosen markets. And importantly, we can provide expert support if you have a claim.

Agricultural autonomation in a changing farm input supplier landscape

In a future where crop protection companies sell risk reduction services, with a shift in focus from product volumes to certainty and quality of outcomes, there would be incentives to use the most optimal, rather than the maximum, amount of chemicals to create the desired result. Our general insurance clients of the future will be farmers adopting agricultural automation which could likely re-shape the crop protection industry. Autonomy is achieved by building upon proven, existing technologies — such as autopilots, precision navigation, flight management systems, and more. Ultimately, this means that the aircraft can aviate, navigate and communicate on its own. Autonomy is not artificial intelligence or machine learning. Instead, it means off-loading routine responsibilities that are traditionally held by human pilots to an autonomous system so that ground operators are free to make fewer, higher-level decisions.

There has been a noticeable shift in the so-called ‘autonomous ag’ space. Autonomous tools are in fields earning their keep all over the world today, and investing in the tech is starting to meaningfully pencil out for producers. In many cases, we’ve moved beyond research concepts and a handful of token pilots.

This includes drone technology equipment that is fully programmable, provides repeatable coverage, is simple to operate, no manual control required, remote control accuracy, intelligent auto-protect return-to-home functionality. Service providers is the new phase of the food production landscape believe every farmer should have the ability to perform their own full-field aerial application. Repeatable and transparent programmable coverage, cost-competitive with existing solutions and simple to operate.

eVTOL

The adoption of electric vertical take-off and landing (eVTOL) aircraft is rapidly expanding segment. We anticipate early adoption Australia as a younger age-profile enters a sector being recognised by Government as a growth pillar of the economy.

An eVTOL aircraft is a simply a variation of vertical take-off and landing (VTOL) aircraft using electric power to hover, take off, and land vertically.

In a future world of aviation we think that electric and hybrid propulsion systems (EHPS) have also the potential of lowering the operating costs of aircraft and can play a significant role in a smart food production future.

So how can we help. We understand the farm pack market in Australia. We have expert staff who can assist in interpreting wordings, understand the cover provided, know where to get appropriate insurance cover and work with underwriting agencies providers to answer questions. We can facilitate increased confidence by obtaining clearer understanding of the indemnity provisions in policy wordings. And importantly, we can provide expert support if you have a claim.

This technology came about thanks to major advances in electric propulsion (motors, batteries, fuel cells, electronic controllers) and the emerging need for new aerial vehicles for urban air mobility that can enable greener and quieter flights. Electric and hybrid propulsion systems (EHPS) have also the potential of lowering the operating costs of aircraft.

Original eVTOL aircraft designs are being developed by original equipment manufacturers (OEMs) that include legacy manufacturers such as Airbus, Boeing, Embraer, Honda, Hyundai, and Toyota, as well as several start-up companies including Archer Aviation, EHang, Joby Aviation, Overair, and Volocopter. Future ag

Sustainable Food & Bio-Innovation – the pursuit of wholesome farm & food sector pursuits

Our food & agriculture business insurance practice includes seeking out high-tech, high-value new market segments in the agri-food segment of the Australian economy.

Seaweed farms also provide habitat for marine life which is important for protecting and enhancing the value of our marine ecosystems and fisheries resources. There are high value end-uses for food, cosmetics, animal feed and other bio products from oceans around us. Seaweed has been eaten for centuries in many countries as it is a highly nutritious food source that is good for gut health. Seaweed is recognised as a superfood and researchers around the world are now looking at seaweed’s potential medical applications.

We are focussed on the future. We see opportunities everywhere in food, agriculture and sustainability. Naturally occurring food is king. Native foods used by indigenous people is the gold of the future. Seaweed has been all around us for centuries. Now it is being used to make innovative bio fabrics and bioplastics that can replace plastic and reduce ocean pollution. This is what drives our excitement for a different future. We seek customers in this space, clients involved in using certain types of seaweeds that can be added to animal feed which have been shown to significantly reduce methane emissions when fed to cattle. Legacy systems merging with a new future.

So how can we help. We understand the insurance market in Australia. We have expert staff who can assist in interpreting wordings, understand the cover provided, know where to get appropriate insurance cover and work with underwriting agencies providers to answer key questions. We can facilitate increased confidence by obtaining clearer understanding of the indemnity provisions in policy wordings. And importantly, we can provide expert support if you have a claim.

Businesses in the animal feed & nutrition sector seeking complete feed rations, mineral concentrates, nutritional blocks, or supplements. Their teams provide phone and on-farm nutritional advice and product support. They have technical teams dedicated to the Australian animal nutrition industry. They are also major buyers of materials such as protein meals, by-products, premixes, phosphates, amino acids, and macro- and microminerals.

Products are purchased in accordance with Grain Trade Australia (GTA) standards with prices of often available on a daily basis for their customers suppliers. Feed is produced for monogastric commercial feeds for pigs and poultry, and ruminant commercial feeds. They support the beef, dairy, dogs, aquaculture, horse, hobby farms, pigs, poultry, sheep and the commercial aquaculture industry sectors from prawns to barramundi.

They manufacturer products that go into the human food chain and aim to ensure that the highest standard is met to meet this responsibility. Many of these manufacturers neither support or oppose the use of Genetically Modified Organisms (GMO) in Australian or Global Agriculture and work with our customers to manage their individual GMO expectations, while not disadvantaging their remaining customer base.

So how can we help. We have expert staff with deep domain experience in the agricultural sector who can assist in interpreting wordings, understand the cover provided, know where to get appropriate insurance cover and work with underwriting agencies providers to answer key questions. We can facilitate increased confidence by obtaining clearer understanding of the indemnity provisions in policy wordings. And importantly, we can provide expert support if you have a claim.

Our preference when engaging with clients is to partner with them in determining probable maximum loss scenarios, matching our experience in both agricultural underwriting and general insurance broking to analyse insurable exposures and matching insurance products.

We have relationships with fish farm underwriters providing Aquaculture Stock Mortality (Named Perils) provides cover for (i) Stock and (ii) Marine Equipment. This provides cover for:

a) Loss of Stock – Loss of Stock by death, escape, theft or vandalism by one or more of the following named perils:

• Pollution, Malicious acts (including malicious acts of environmental or animal rights groups), Theft, Predation, Flood, Storm, Drought, Fire, lightning, explosion, Earthquake, tsunami, volcano

• Losses directly or indirectly attributable to freezing, frost damage, low or high water temperatures;

• Mechanical or electrical breakdown or accidental damage to machinery and other installations as used on farms, failure or interruption of the electricity supply, electrocution;

• Algal Bloom, Jellyfish Bloom;

• Any other change in concentration of the normal chemical constituents of the water, including but not limited to supersaturation with dissolved gases, change in pH or salinity and suspended solids but excluding losses directly or indirectly attributable to Algal Bloom or Jellyfish Bloom;

• Disease.

b) Marine equipment – Cover is provided for Marine equipment as listed on the policy schedule for named perils.

c) Mitigation expenses – Indemnify is provided in respect of reasonable expenses over and above normal additional operational costs expenses incurred by the Insured solely and specifically in order to minimise a loss which is occurring, or to avert the risk of an imminent loss, for which loss coverage is or would be available to the Insured.

So how can we help.

We have expert staff with deep domain experience in the agricultural sector who can assist in interpreting wordings, understand the cover provided, know where to get appropriate insurance cover and work with underwriting agencies providers to answer key questions. We can facilitate increased confidence by obtaining clearer understanding of the indemnity provisions in policy wordings. And importantly, we can provide expert support if you have a claim.

So how can we help. Our food and agribusiness division provides industry-focused insurance risk advice and claims advocacy services to clients across industries. We aim to strike a balance between technological innovation and personal engagement. We have expert staff with deep domain experience in the agricultural sector who can assist in interpreting wordings, understand the cover provided, know where to get appropriate insurance cover and work with underwriting agencies providers to answer key questions. We can facilitate increased confidence by obtaining clearer understanding of the indemnity provisions in policy wordings. And importantly, we can provide expert support if you have a claim.

So how can we help. We have existing clients in the AgriTech space. We have people with deep domain experience in the agricultural sector who can assist in interpreting wordings, understand the cover provided, know where to get appropriate insurance cover and work with underwriting agencies providers to answer key questions. Professional indemnity insurance is second nature to us. We can facilitate increased confidence by obtaining clearer understanding of the indemnity provisions in policy wordings. And importantly, we can provide expert support if you have a claim.

So how can we help. Our food and agribusiness division provides industry-focused insurance risk advice and claims advocacy services to clients across industries. Professional indemnity is second nature to use. We have expert staff with deep domain experience in the agricultural sector who can assist in interpreting wordings, understand the cover provided, know where to get appropriate insurance cover and work with underwriting agencies providers to answer key questions. We can facilitate increased confidence by obtaining clearer understanding of the indemnity provisions in policy wordings. And importantly, we can provide expert support if you have a claim.

Broadacre farmers are increasingly having to modernise and invest in very expensive machinery, plant and equipment technology that require correct vehicle insurance to protect their investment.

Broadacre farming is a term you hear primarily in Australia, generally referring to a farming operation with livestock or crops that are more suitable to large scale production. It could involve producing oilseeds or grains such as barley, wheat, sorghum, peas, hemp, maize, sunflower or safflower. Using grazing livestock for either wool or meat are other common investments. Field crops grown in Australia include:

• winter cereals (wheat and barley)

• summer cereals (sorghum and maize)

• winter pulses (chickpea and faba bean)

• summer pulses (soybean and mungbean)

• cotton

• peanuts

• sunflower

• canola

• specialty crops (triticale, navy beans, lentils, rice, field peas, hemp etc).

• sugar cane

So how can we help. Our food and agribusiness division provides industry-focused insurance risk advice and claims advocacy services to clients across industries. We have people with deep domain experience in the agricultural sector who can assist in interpreting wordings, understand the cover provided, know where to get appropriate insurance cover and work with underwriting agencies providers to answer key questions.

We can facilitate increased confidence by obtaining clearer understanding of the indemnity provisions in policy wordings. And importantly, we can provide expert support if you have a claim. We are farm package experts and can provide insight on small details and covers in policy wordings.

Blue carbon credits can help offset the carbon in our oceans through coastal wetland, coastline mangrove, tidal marsh, salt marsh, and seagrass meadow restoration projects and new plant-life growth in marine ecosystems. Like carbon credits that focus on inland plant life that sequesters carbon, blue carbon projects look to stop the loss of this helpful plant life or aid the growth of new plant life to help absorb carbon emissions from their ocean habitats and slow climate change.

Like any other carbon credit, an individual or business donates funds to a blue carbon credit program, and the amount they donate helps offset a certain amount of carbon emissions they produce. These carbon credits come in all sizes, ranging from:

• enough to offset a flight, to

• enough to offset remaining corporate emissions, after making all the carbon emission reductions a business could.

So how can we help. Our food and agribusiness division provides industry-focused insurance risk advice and claims advocacy services to clients across industries. Professional indemnity insurance is second nature to us. We have people with deep domain experience in the agricultural sector who can assist in interpreting wordings, understand the cover provided, know where to get appropriate insurance cover and work with underwriting agencies providers to answer key questions. We can facilitate increased confidence by obtaining clearer understanding of the indemnity provisions in policy wordings. And importantly, we can provide expert support if you have a claim.

At Omnisure we value natural capital in the natural world around us. In our food and agribusiness practice we love engaging with enterprises who provide ecosystem services and bio-products. We seek out customers who embrace a sustainable business model. We want to partner with them help them and help us create similar a general insurance broking practice, working towards an aligned insurance risk-advice business of the future.

It is not only Australia seeking increased resilience in the food chain. The whole world is suffering from catastrophic weather events impacting global economies.

Carbon verification is when a third-party verification organization inspects a carbon offset program and ensures it meets its standards. If the program meets the standards, the carbon offset credits are verified, making them safe for consumers to purchase and offset their own carbon footprint. There is a growing number of consultancy firms in Australia who can help farmers, and notably graziers, achieve their carbon farming potential, provide concise insights from expert panels to deepen farmers’ understanding of how dry times impact soil carbon projects (including graziers on large rangeland properties), water management, sustainable agriculture, advising on property transition and farm nutrient management. As they provide consulting services to measure, report and verify (MRV) for emissions and mitigation in livestock and agroforestry, they taken professional indemnity exposures. We can provide expert insurance broking service & advice in relation to professional indemnity insurance contracts.

Carbon consulting firms can support graziers with all registration, reporting and audit submissions including mapping, baselining and sampling management, emissions and abatement estimates, Land Management Strategy creation, and fees involved in their carbon project. We keep you informed of the newest opportunities, such as nature and methane credits, with continued specialist support. Others will help guide clients understand whether their property is eligible for a carbon farming project.

Our food and agricultural insurance practice anticipates growth of specialist consulting enterprises in the future pursuing actionable sustainability solutions for clients, with flexible and convenient offset packages that support verified initiatives that restore the planet’s carbon balance.

So how can we help. Our food and agribusiness division provides industry-focused insurance risk advice and claims advocacy services to clients across industries. Professional indemnity insurance is second nature to us. We have people with deep domain experience in the agricultural sector who can assist in interpreting wordings, understand the cover provided, know where to get appropriate insurance cover and work with underwriting agencies providers to answer key questions. We can facilitate increased confidence by obtaining clearer understanding of the indemnity provisions in policy wordings. And importantly, we can provide expert support if you have a claim.

Green-e certification for landfill gas capture

There will be a growing number of firms specialising in Green-e certification type services, such as that offered by Terrapass. We see a future where dairy farms in Australia adopting aerobic digesters at their facilities to capture GHGs being released into the atmosphere that become eligible for Green e-certification as well as provide renewable electricity for the farm off the grid. Green-e Energy Certified renewable energy credit (REC) are also sometimes referred to as a renewable energy certified or green tag – is created for each megawatt hour (1 MWh, or 1000 kilowatt-hours) of renewable electricity generated and delivered to the power grid.

An example is Grotegut Dairy Farm is a family run dairy operation in Newton, Wisconsin in the USA. Grotegut voluntarily installed an aerobic digester at their Newton facility in 2009. The Project activity reduces the GHGs that were being released into the atmosphere prior to the project activity, as well as provides renewable electricity for the farm and the grid. We anticipate further innovation will follow in Australia, a country that has proven to be early an adopter of new technology.

So how can we help. Our food and agribusiness division provides industry-focused insurance risk advice and claims advocacy services to clients across industries. We have people with deep domain experience in the agricultural sector who can assist in interpreting wordings, understand the cover provided, know where to get appropriate insurance cover and work with underwriting agencies providers to answer key questions. We can facilitate increased confidence by obtaining clearer understanding of the indemnity provisions in policy wordings. And importantly, we can provide expert support if you have a claim.

We wish to work with carbon project developers providing expert insurance advice to them in relation to their professional indemnity exposures in the advice they provide and the professional services they offer as they play their role in increasing and diversifying agricultural participation in carbon markets.

So how can we help.

Landowners (and farmers in particular) are realising the importance of their natural assets such as their soil and the land. They are interested in actively managing their land to reduce emissions or increase carbon storage. They want to start managing their carbon but are unsure of where to start or who to trust for information. Carbon program designers in Australia play a big role in developing the carbon markets for all participants.

In our food and agribusiness division we strive keep abreast of the Carbon Market landscape from an insurance standpoint. We do this to be relevant to our food and agribusiness clients from an insurance standpoint. We are neither carbon market consultants nor environmental lawyers. But we can facilitate increased confidence by obtaining clearer understanding of the indemnity provisions in policy wordings. And importantly, we can provide expert support if you have a claim.

Carbon markets span from emitters with emission permits (allowances) on one side, to carbon credits (offsets) on the other. As a general insurance intermediary in the food and agricultural landscape, our main interest is in deepening the ‘offset’ side of the market that involves carbon sequestration in agriculture, recognising that agriculture has dominated the government’s Emissions Reductions Fund (ERF) by a substantial margin.

According to the CSIRO, by 2050 the carbon market could provide an income of about $40 billion to the land sector. The really exciting aspect of the future is exploring how this projected growth of carbon farming supports the growth of Australian agriculture, instead of replacing it. This would see more money come back through the farm gate to invest in land management, infrastructure upgrades and business sustainability.

Our expertise – We have expertise in our general insurance practice that spans from agricultural underwriting and insurance broking across crops, forestry, horticulture, cotton, livestock, viticulture, farm packing (including public & product liability), professional indemnity, directors & officers liability, association liability, information technology & communication liability, environmental liability insurance and claims settlement in the agricultural value chain. We can provide expert advice on indemnity provisions in financial lines policy wordings such as professional indemnity insurance which can provide support to both professional service providers and provide increased confidence to their clients.

The Circular Head mayor Daryl Quilliam grew up on a farm in the area and said he has seen a big change in farm ownership over his lifetime. When he was young, his parents milked about 50-60 cows and that wasn’t far away from the average. The recent trend in the region has been towards share farming: where a corporate body purchases the farming property and local farmers invest through stock and the running of the farm. But young farmers still have a path forward. Stephen Armstong started small in his farming success in the same region, by gaining equity in dairy cows. They would rear 50 calves a year, sell them and buy another 70. We can provide expert agricultural insurance advice to startup farmers or large family farms.

So how can we help – We have experience in dealing with corporate agriculture – from member owned cooperative to large family offices. Some of our people have worked with clients in private wealth insurance and are familiar with corporate structures. We have existing experience with high net-worth individuals and their corporate entities. Our food and agribusiness division provides industry-focused insurance risk advice and claims advocacy services to clients across industries. We have people with deep domain experience in the agricultural sector who can assist in interpreting wordings, understand the cover provided, know where to get appropriate insurance cover and work with underwriting agencies providers to answer key questions. We provide clients from the corporate sector, to SME, to retail sectors. We can facilitate increased confidence by obtaining clearer understanding of the indemnity provisions in policy wordings. And importantly, we can provide expert support if you have a claim.

Winter cereals include wheat, barley, oats, canary, and triticale. Winter legume crops include peans and beans amongst others.

Canola, maize, rice, cotton and sunflowers are gown at slightly different times of the year according to climate.

So how can we help. Our food and agribusiness division provides industry-focused insurance risk advice and claims advocacy services to clients across industries. We have people with deep domain experience in the agricultural sector who can assist in interpreting wordings, understand the cover provided, know where to get appropriate insurance cover and work with underwriting agencies providers to answer key questions. We can facilitate increased confidence by obtaining clearer understanding of the indemnity provisions in policy wordings. And importantly, we can provide expert support if you have a claim. We are farm package experts and can provide insight on small details and covers in policy wordings, such as protection for tree breaks on your farm.

We can partner and engage with supply chain management companies, importers and exporters of grain for stockfeed or export for milling, commodity trading businesses.

So how can we help. Our food and agribusiness division provides industry-focused insurance risk advice and claims advocacy services to clients across industries. We have insurance experience dealing with customers involved in the export of Australian frozen, raw unprocessed, and/or processed food.

We have relationships with insurance companies who can assist with products in this segment. We have people with deep domain experience in the agricultural sector who can assist in interpreting wordings, understand the cover provided, know where to get appropriate insurance cover and work with underwriting agencies providers to answer key questions. We can facilitate increased confidence by obtaining clearer understanding of the indemnity provisions in policy wordings. And importantly, we can provide expert support if you have a claim.

The cotton farming industry is very well established in Australia and supports the whole value chain. Cotton is a food and a fibre crop. It can be used to make clothes, homewares, and industrial products and Cotton seed can be used as stock feed.

So how can we help. Our food and agribusiness division has experience in Association liability insurance and agricultural cooperatives. We have people who have been involved in setting up mutual funds for cotton farmers, and understand crop underwriting. We provide industry-focused insurance risk advice and claims advocacy services to clients across industries.

We have people with deep domain experience in the agricultural sector who can assist in interpreting wordings, understand the cover provided, know where to get appropriate insurance cover and work with underwriting agencies providers to answer key questions. We can facilitate increased confidence by obtaining clearer understanding of the indemnity provisions in policy wordings. And importantly, we can provide expert support if you have a claim. We are farm package experts and can provide insight on small details and covers in policy wordings, such as protection for tree breaks on your farm.

Cotton lint – Cotton is known for its versatility, performance and natural comfort. Cotton’s strength and absorbency makes it an ideal fabric to make clothes and homewares, and industrial products like tarpaulins, tents, hotel sheets, army uniforms, and even astronauts’ clothing choices when inside a space shuttle. Cotton fibre can be woven or knitted into fabrics including velvet, corduroy, chambray, velour, jersey and flannel.

Cotton farmers face both conventional risks to their enterprises spanning from infrastructure, farm vehicles and heavy equipment, homesteads, motor vehicles, labour hire, public and product indemnity. But they also face significant exposure to hail damage to their cotton crop. We can assist in providing expert farm package advice. We can also provide crop insurance services as well as insurance solutions covering their infrastructure, sheds, farm vehicles including cotton pickers.

Cotton can be used to create dozens of different fabric types for a range of end-uses, including blends with other natural fibres like wool, and synthetic fibres like polyester.

In addition to textile products like underwear, socks and t-shirts, cotton is also used in fishnets, coffee filters, tents, book binding and archival paper. Linters are the very short fibres that remain on the cottonseed after ginning, and are used to produce goods such as bandages, swabs, bank notes, cotton buds and x-rays. The cotton lint from one 227kg bale can produce 215 pairs of denim jeans, 250 single bed sheets, 750 shirts, 1,200 t-shirts, 3,000 nappies, 4,300 pairs of socks, 680,000 cotton balls, or 2,100 pairs of boxer shorts.

Australian cotton growers have been quietly and collaboratively working to improve their sustainability performance for decades. In 1991 cotton became the first Australian agricultural industry to benchmark its environmental performance, and more recently the cotton industry – led by CRDC and Cotton Australia – have been working towards developing sustainability targets. The Cotton Industry’s sustainability work and myBMP program continue to be recognised by an increasing number of global sustainability programs:

• Better Cotton Initiative (BCI), with Cotton Australia a Strategic Partner. The myBMP Standard has been mapped and aligns with the BCI Standard.

• CottonLEADS – Cotton Australia’s partnership with the US Cotton Foundation.

• Partnership for Sustainable Textiles – myBMP is accredited by the partnership.

• International Trade Centre (ITC) Sustainability Map, first published in March 2019.

• The Textile Exchange – myBMP data is included in Preferred Textile reports.

• Forum for the Future, CottonUP Guide – a practical guide to sourcing more sustainable cotton, with myBMP included as a sourcing option.

So how can we help. Our food and agribusiness division provides industry-focused insurance risk advice and claims advocacy services to clients across industries. We have experience with customers in AgriTech space. We have expert staff with deep domain experience in the agricultural sector who can assist in interpreting wordings, understand the cover provided, know where to get appropriate insurance cover and work with underwriting agencies providers to answer key questions. We can facilitate increased confidence by obtaining clearer understanding of the indemnity provisions in policy wordings. And importantly, we can provide expert support if you have a claim.

The desired outcome is to help meet the ever-growing national & global demand for sustainability metrics (notably generated with product Life Cycle Assessment ) to provide authoritative, comprehensive and transparent environmental information on agricultural products and services over their entire life cycle. We anticipate new & supporting enterprises to coalesce around the growing array of data services that will proliferate whilst the food and agri-sector starts providing value-adding insights from interpretation of quality data.

So how can we help. Our food and agribusiness division provides industry-focused insurance risk advice and claims advocacy services to clients across industries. We have people with deep domain experience in the agricultural sector who can assist in interpreting wordings, understand the cover provided, know where to get appropriate insurance cover and work with underwriting agencies providers to answer key questions. We can facilitate increased confidence by obtaining clearer understanding of the indemnity provisions in policy wordings. And importantly, we can provide expert support if you have a claim.

Digitally transforming Australia’s agrifood supply chain.

This will allow for a streamlined approach to regulating different prescribed commodities and will ensure the framework is more accessible for exporters. The CSIRO is working towards an integrated digitised regulations and protocols with digitised workflows and automated compliance checking tools, while linking different parties along the supply chain.

This approach to digitisation and automation of export compliance, with the aim of to map compliance workflows, will prioritise areas of highest return from investment, and deploy fit- for-purpose technologies that will facilitate the export segment.

So how can we help. Our food and agribusiness division provides industry-focused insurance risk advice and claims advocacy services to clients across industries. Professional indemnity is second nature to use.

We have relationships with insurance companies who operate in this sector. We have expert staff with deep domain experience in the agricultural sector who can assist in interpreting wordings, understand the cover provided, know where to get appropriate insurance cover and work with underwriting agencies providers to answer key questions. We can facilitate increased confidence by obtaining clearer understanding of the indemnity provisions in policy wordings. And importantly, we can provide expert support if you have a claim.

This includes dairy cooperatives, cotton mills and other participants who help open local producers to domestic and international markets, whether this be for freshly harvested fruit, or the manufacturing of organic and/or conventional products into speciality products (for example converting fresh milk into value added milk powders, cheese, cream and butter).

So how can we help. Our food and agribusiness division provides industry-focused insurance risk advice and claims advocacy services to clients across industries. We have expert staff with deep domain experience in the agricultural sector who can assist in interpreting wordings, understand the cover provided, know where to get appropriate insurance cover and work with underwriting agencies providers to answer key questions. We have relationships with insurers who conduct businesses in this segment. We can facilitate increased confidence by obtaining clearer understanding of the indemnity provisions in policy wordings. And importantly, we can provide expert support if you have a claim.

Exporters of local hay are required to deal with the complexity of global specialty animal feed supply chains. Especially in the equestrian market some of these products have known attributes – Prime Lucerne is known for high quality protein and & energy levels, calcium, magnesium, Vitamin A & E. Oaten is recognised for high fibre levels & requires more chewing, which stimulates saliva production, lower levels of protein, high palatability. Clover is recognised higher protein, calcium and palatability. Cereal Straw is less energy dense and experienced operators in the industry know that cereal straw substitute up to 50% of grass hay to achieve less energy density (where such diets are indicated from time to time such as in the equestrian industry).

How can we help. Our food and agribusiness division provides industry-focused insurance risk advice and claims advocacy services to clients across industries. We have people with deep domain experience in the agricultural sector who can assist in interpreting wordings, understand the cover provided, know where to get appropriate insurance cover and work with underwriting agencies providers to answer key questions. We can facilitate increased confidence by obtaining clearer understanding of the indemnity provisions in policy wordings. And importantly, we can provide expert support if you have a claim.

Hay for the international horse breeding sector

So how can we help. Our food and agribusiness division provides industry-focused insurance risk advice and claims advocacy services to clients across industries. Professional indemnity is second nature. We have expert staff with deep domain experience in the agricultural sector who can assist in interpreting wordings, understand the cover provided, know where to get appropriate insurance cover and work with underwriting agencies providers to answer key questions. We can facilitate increased confidence by obtaining clearer understanding of the indemnity provisions in policy wordings. And importantly, we can provide expert support if you have a claim.

Soil carbon sequestration is a key component of the Australian Government’s technology-led emissions reduction policy. It is also included in Australia’s National Soil Strategy as a crucial part of efforts to improve soil health. As we seek to partner with consulting firms who are carbon sequestration project managers and/or product designers, farmers wanting to start their carbon journey are faced with uncertainty. They lack knowledge, struggle to find meaningful information, and don’t know who to trust. On the other hand, there are also opportunities for farmers who utilise management practices that build carbon to earn additional revenue from carbon credits. These are big decisions for them.

So how can we help:

Farmers retain their conventional farm exposures, and they stand to benefit from ensuring their counterparties are properly insured for the expert advice and services provided to them for their farm sequestration carbon journey. In our food and agribusiness division we strive keep abreast of the Carbon Market landscape from an insurance standpoint. We do this to be relevant to our food and agribusiness clients from an insurance standpoint.

Carbon markets span from emitters with emission permits (allowances) on one side, to carbon credits (offsets) on the other. As a general insurance intermediary in the food and agricultural landscape, our main interest is in deepening the ‘offset’ side of the market that involves carbon sequestration in agriculture, recognising that agriculture has dominated the government’s Emissions Reductions Fund (ERF) by a substantial margin. We are neither carbon market consultants nor environmental lawyers.

- We can facilitate increased confidence by obtaining clearer understanding of the indemnity provisions of the professional service providers in this carbon market space by professional consultants in the carbon market space.

- And importantly, we can provide expert support if you have a claim.

Background information

Conventional primary producers include farmers seeking the potential to improve on-farm environmental outcomes as a key motivator for undertaking carbon off-set projects on their farmland, improving the natural capital and environmental outcomes of their farms. Carbon offset projects range from sequestration projects, agricultural emissions avoidance projects, indigenous savanna burning projects to non-indigenous savanna burning projects.

Soil Carbon Consultants

Soil carbon sequestration means adopting practices – most often in the agricultural sector – that increase the amount of carbon stored in soils. Agricultural management practices might include:

- increasing plant growth or cover

- adding compost or mulch

- decreasing losses through reduced stubble burning or minimal till practices

- increasing the clay content of sandy soils.

A key challenge is developing sequestration technologies that are cost-effective, and that produce meaningful abatement at national-to-global scales.

Another challenge is that the diversity of soils and agricultural systems across Australia makes it difficult to develop consistent accounting metrics for soil carbon.

Australia has made a commitment to Net Zero emissions by 2050. Each year, the National Greenhouse Gas Inventory reports all greenhouse gas emissions across all sectors, and the Emissions Reduction Fund (ERF, provides the financial mechanism to incentivise industries to either reduce emissions, or increase sequestration, contributing to the emission reduction targets set under the Paris Agreement.

The soil in which a crop was grown in can provide unique data points to validate its origin. The SCIRO is conducting research to provide nationally consistent, timely and accessible soil data to support development and management decisions at national, regional and local levels. Our soils are a valuable national asset, and their proper management is vital for Australia’s resilient and sustainable future. To restore and manage our soils for the benefit of all, we need appropriate and relevant soil information.

Various research projects are funded by Hort Innovation, using the Australian Horticulture research and development levies, and contributions from the Australian Government. Hort Innovation is the grower-owned, not-for-profit research and development corporation for Australian horticulture.

Various research projects are funded by Hort Innovation, using the Australian Horticulture research and development levies, and contributions from the Australian Government. Hort Innovation is the grower-owned, not-for-profit research and development corporation for Australian horticulture.

We deal with agricultural associations and agricultural shows. Nut Producers Australia processes and markets the almonds and pistachios grown by its shareholder growers. This means they are totally invested in delivering our quality promise to their customers. As a team of growers, processors and marketers, we promise to deliver the product quality our customers expect every time, on time. We have sufficient scale and capacity to meet the needs of our customers, but agile enough to personalise our service. Nut farmers face conventional risks to their enterprises spanning from infrastructure, farm vehicles and heavy equipment, homesteads, motor vehicles, labour hire, public and product indemnity. We can assist in providing expert farm package advice.

We have experience in providing expert advice to director and officers of agricultural associations for association liability exposures. Nuts for Life is Australia’s voice for the crucial role nuts play in good health and nutrition. On behalf of the nut industry, and work closely with health professionals, government, and other bodies to improve the nutritional reputation of nuts.

Primary producers across process a very wide range of farming occupations from Poultry (poultry-meat, poultry-eggs, poultry-breeding), pigs, sheep-wool, sheep-mutton, goats-meat, goats-mohair, cashmere, dairy and many other producers can protect themselves with farm package insurance.

So how can we help. We are experts in this space. Our food and agribusiness division provides industry-focused insurance risk advice and claims advocacy services to clients across industries.

It is important to know how your dwelling is insured. We can assist our customers understand the difference between ‘Cover Types’ – accidental damage versus defined benefits.

Basis of settlement – Farm sheds are often only offered with an Indemnity basis of settlement. This means that newer sheds in good condition may not be replaced with the same shed if market conditions have changed. We can assist you with an increased understanding of the ‘Basis of Settlement’ options available in the farm market space.

Some high value homes need special care when being insured. It is important to understand whether heritage status applies to some homestead and sheds.

We can provide expert advice on your claim in the event that we disagreed with a determination made by your insurer because we have claims experience working in this sector including experience with farm claims involving the Australian Financial Complaints Authority.

We have people with deep domain experience in the agricultural sector who can assist in interpreting wordings, understand the cover provided, know where to get appropriate insurance cover and work with underwriting agencies providers to answer key questions.

We can facilitate increased confidence by obtaining clearer understanding of the indemnity provisions in policy wordings. And importantly, we can provide expert support if you have a claim. We are farm package experts and can provide insight on small details and covers in policy wordings, such as protection for tree breaks on your farm and explain your exposure for legal liability across your private (non-business civilian liability), farming business liability and motor vehicle liability (non-registered vehicle) exposures.

We can support farmers ranging from cropping, pastoralists, fruit growing to intensive agriculture across pigs, poultry, dairy, insects and aquaculture.